child tax credit portal update new baby

Half of the money will come as six monthly payments and half as a 2021 tax credit. How parents with new babies can claim the Child Tax Credit.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

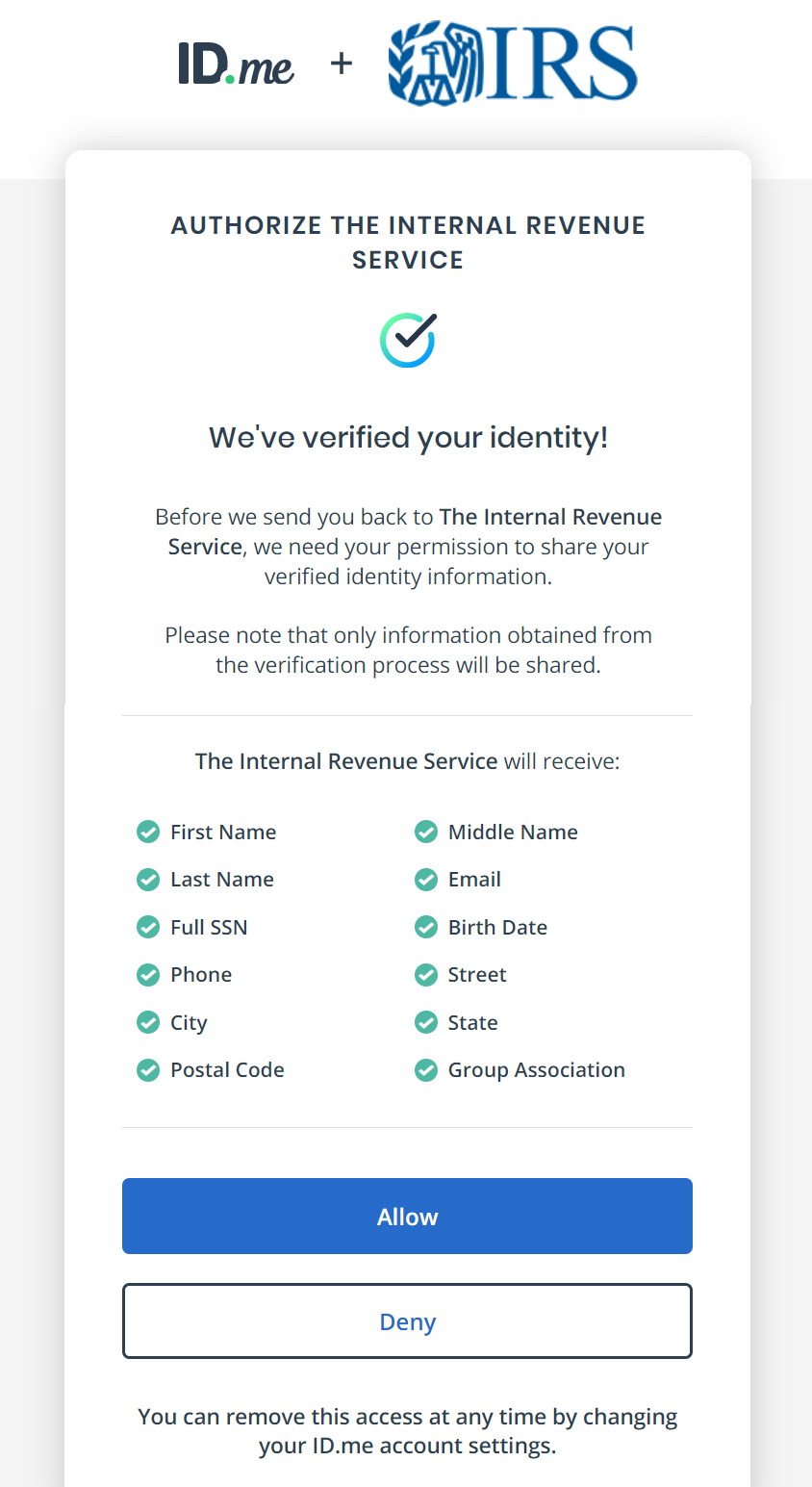

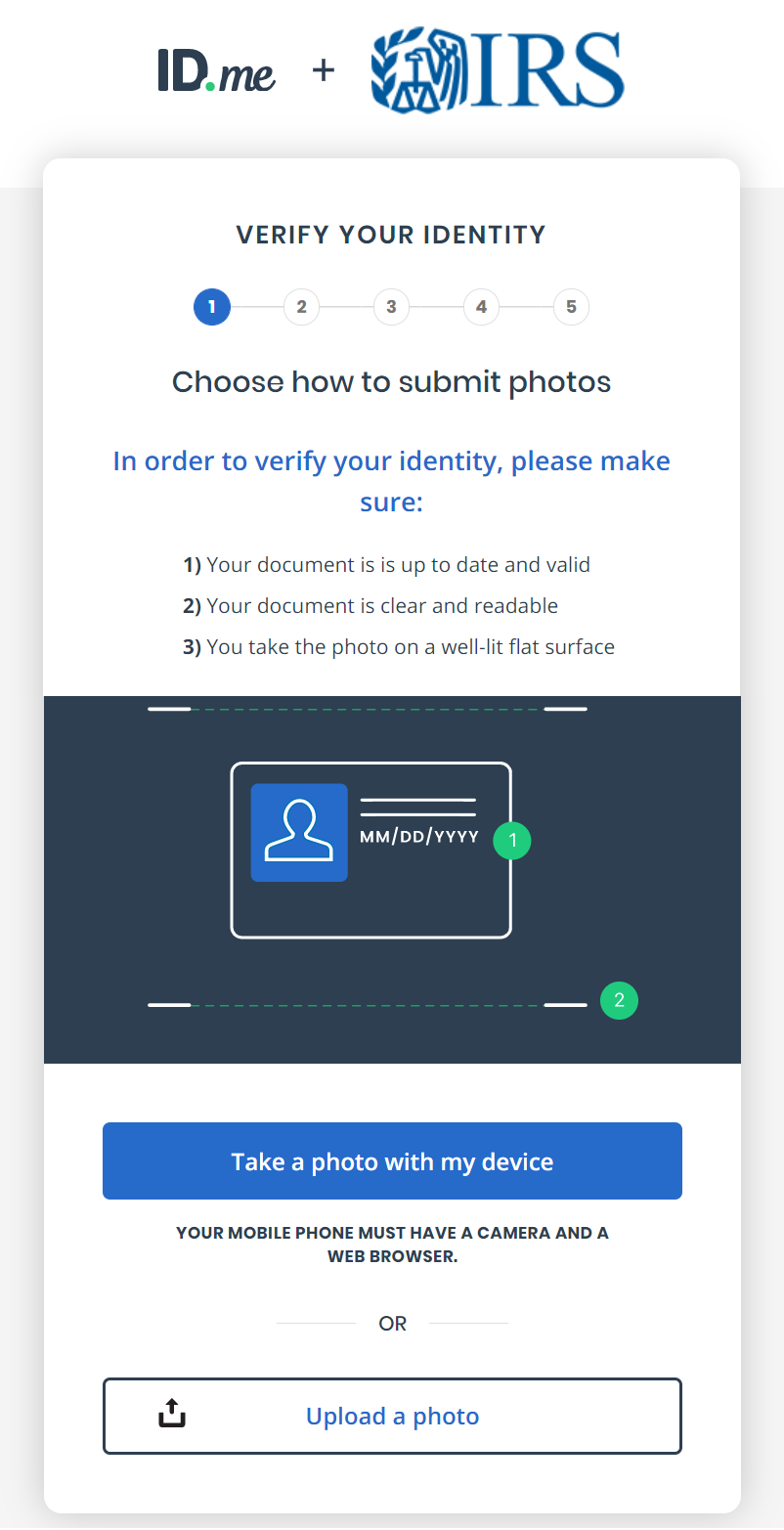

One portal will allow.

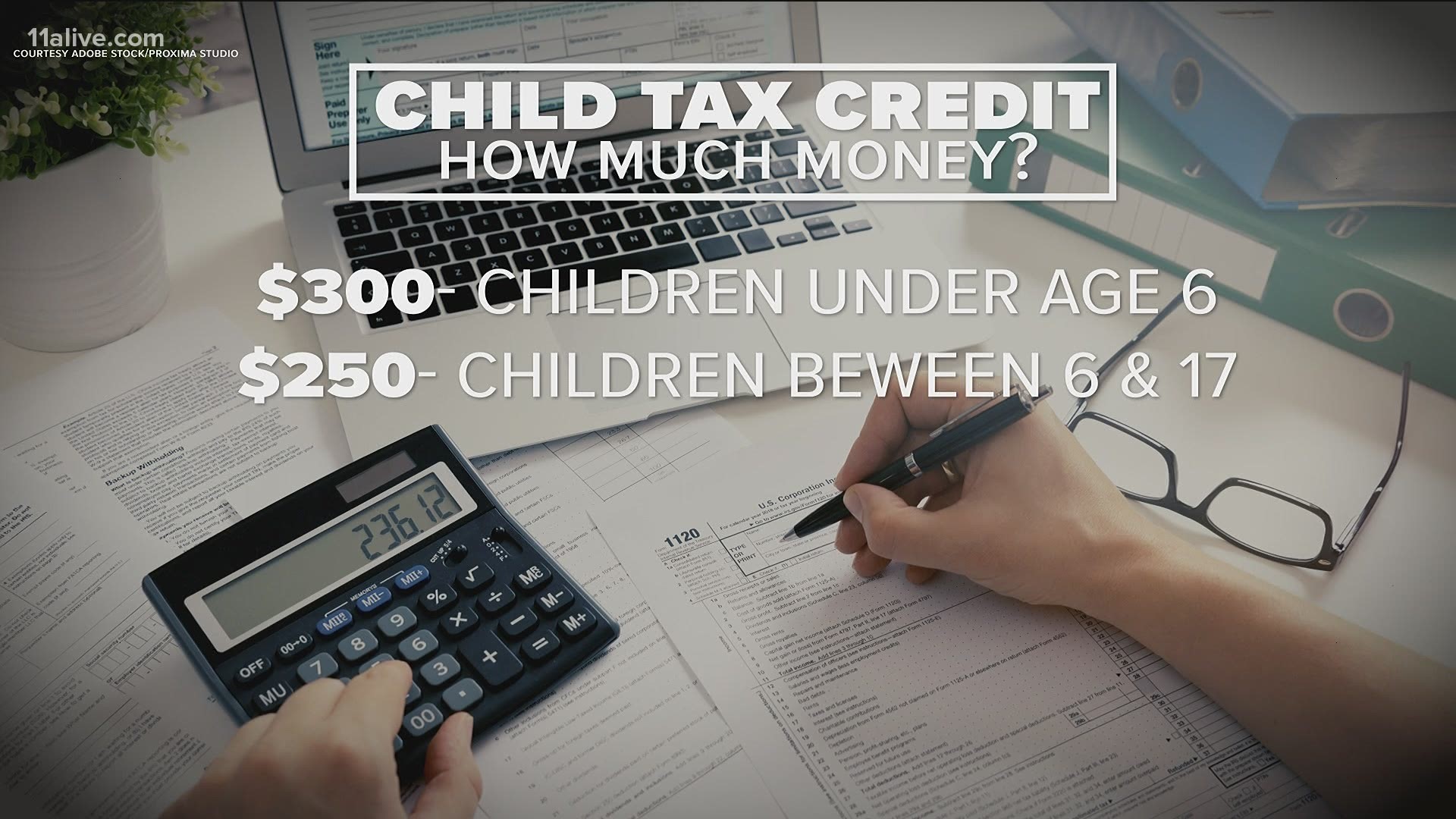

. An IRS spokesperson said that one of the planned enhancements for the Child Tax Credit Update Portal found on IRSgov will enable parents to add children. The IRS will pay 3600 per child to parents of young children up to age five. The American Rescue Plan which I was proud to support expanded the Child Tax Credit to provide up to 3600 for children under the age of 6 and 3000 for children under the.

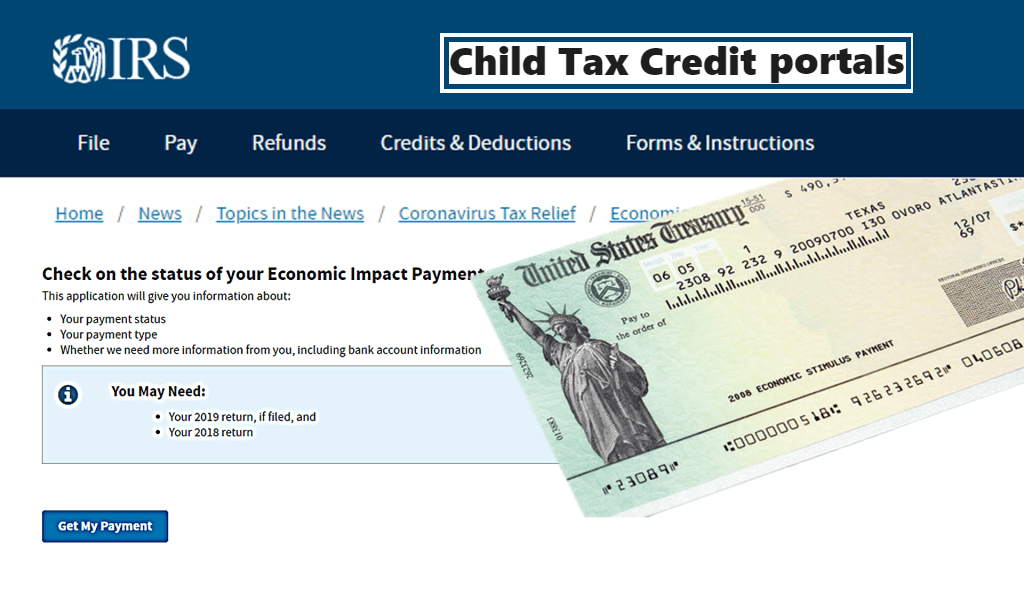

The IRS has promised to launch two online tools by July 1. August 31 2021 122 PM. Your 2021 Baby Makes You Eligible for the Child Tax Credit The second portal will allow eligible non-filers to provide the necessary information to the IRS in order to.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. To be a qualifying child for.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. Families who are expecting a baby to arrive this year can also claim the child tax credit cash. When you claim this credit when filing a tax return you can lower the taxes you owe and.

The maximum value of the credit rose from 2000 per child to 3000 for children aged 6 to 17 and 3600 for those under age 6. New IRS Update To Child Tax Credit Portal Allows Parents to Update Their Address. The boosted Child Tax Credit was also made.

The Child Tax Credit CTC provides financial support to families to help raise their children. The Child Tax Credit Update Portal which is an IRS tool that lets you check on the status of your Child Tax. Now instead of 2000 parents can claim 3600 for children under the age of six and 3000 for kids between six and 17.

The credit is divided by 12 with one-twelfth deposited.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Stimulus Payments For 2021 Babies How Does It Work 11alive Com

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Update Irs Launches Two Online Portals

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Have Questions About The New Expanded Federal Child Tax Credit Here S How It Will Work Idaho Capital Sun

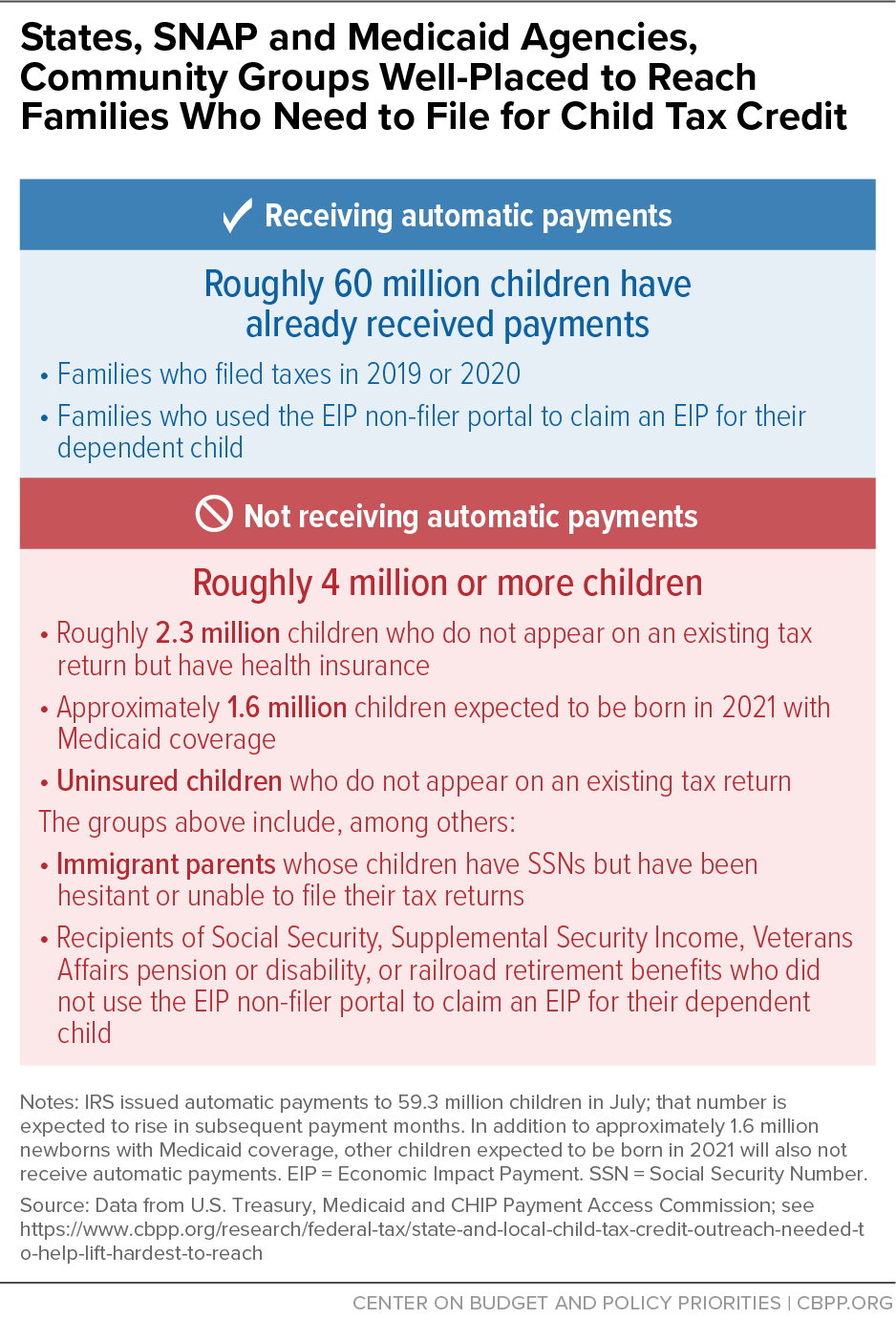

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Child Tax Credit Irs To Open Portals On July 1 Checks Will Begin July 15 Where S My Refund Tax News Information

What Families Need To Know About The Ctc In 2022 Clasp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit December 2021 How To Track Your Payment Marca

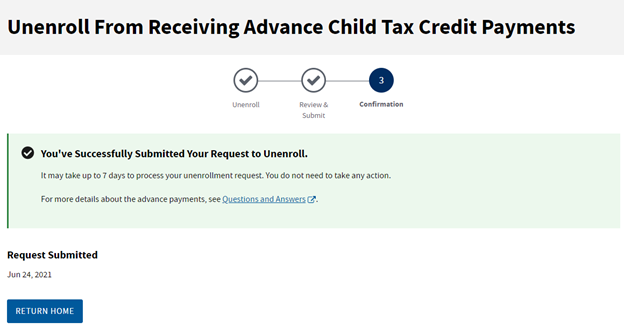

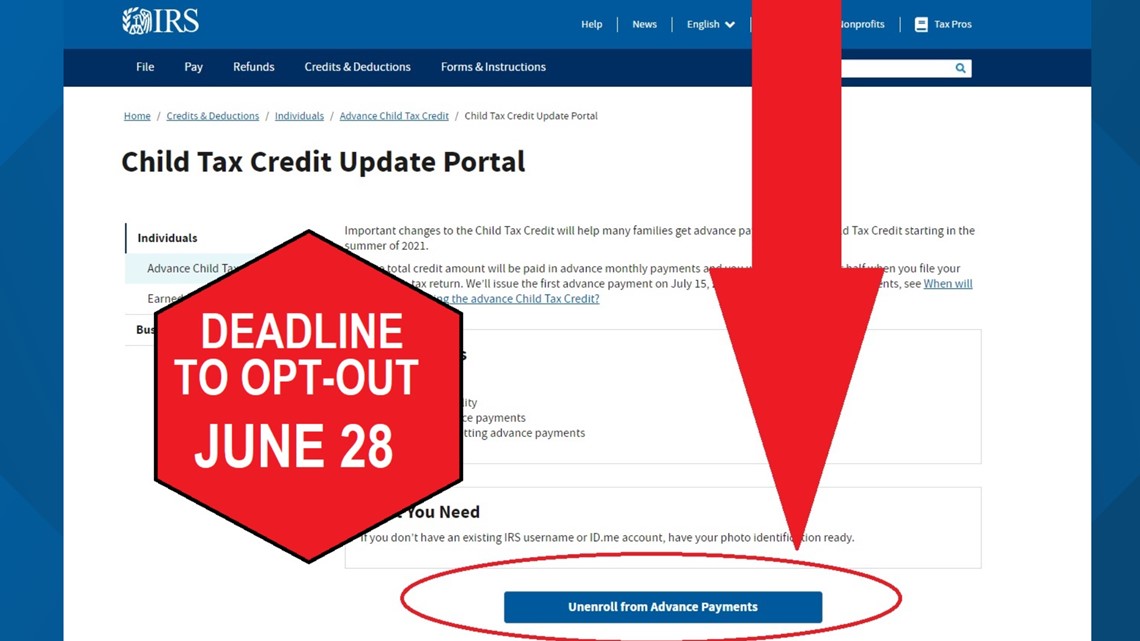

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Childctc The Child Tax Credit The White House

How To Give The Irs Updated Bank Information For The Child Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZGOGMJW7CFAADD46R4635RUAVM.png)

Monday Is The Last Day To Update Child Tax Credit Information With The Irs

Child Tax Credit For 2022 Here S How Some Families May Get 7 200 Next Year

Child Tax Credit How It Works Under The New Stimulus Bill

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time